Pipeline Inspection and Integrity Services

Pipeline Inspection and Integrity Services

The increasing complexity of mandatory pipeline integrity programs, together with increased governmental rules and regulations, has led many pipeline operators to outsource inspection and integrity services to independent service providers that have a proven track record of performance. Independent inspectors assist the pipeline operators with performing multiple tasks associated with documentation and project oversight of their asset integrity programs and related construction, inspection, maintenance and repair activities. Independent inspectors generally operate as an extension of the pipeline operators’ management and employees where additional experienced personnel are needed to perform pipeline inspection and integrity services.

Pipeline Inspection

The U.S. interstate oil and natural gas pipeline inspection industry is regulated and governed by the U.S. Department of Transportation Pipeline and Hazardous Materials Safety Administration, or PHMSA. According to PHMSA’s Annual Report Mileage Summary, there are more than 2.3 million miles of transmission and distribution pipelines in the U.S. carrying natural gas and petroleum and refined petroleum products. There also are millions of miles of gathering systems connecting oil and natural gas wells to pipelines, natural gas plants, storage terminals and other transportation or storage facilities as well as additional pipelines and gathering systems under construction. Every mile of pipeline is susceptible to risks such as internal and external corrosion, cracking, third-party damage and manufacturing flaws. To mitigate the risk of environmental damage and enhance public safety, government regulation mandates that pipeline operators assess the safety and integrity of their pipeline infrastructure on a recurring basis. PHMSA guidelines identify the minimum standards for evaluating the integrity and safety of pipeline assets and facilities by requiring certain periodic inspections.

Integrity Management

Due to the impact of PHMSA regulations and oversight, the potential fines for non-compliance at both federal and state levels and the excessive unplanned costs associated with spill remediation, all of which can negatively impact a pipeline’s performance, pipeline operators are compelled to develop and implement comprehensive integrity management programs. An integrity management program is a set of safety management, analytical, operations, and maintenance processes that are implemented to assure that operators provide protection for locations where a pipeline failure could have significant adverse consequences. An integrity management plan should also specifically address ‘‘high consequence areas,’’ or HCAs. HCAs include those areas that are unusually sensitive to environmental damage, that cross a navigable waterway or that have high population density.

The elements of an integrity management program include:

- maintaining full documentation of the pipeline infrastructure for the lifespan of the asset;

- identifying all locations where a pipeline failure might impact an HCA;

- developing a risk-based plan to conduct integrity assessments on the portions of the pipeline that could affect an HCA;

- integrating the assessment results with other relevant information to improve the understanding of the pipe’s condition;

- repairing defects identified through the integrated analysis of the assessment results;

- conducting a risk analysis to identify the most significant pipeline threats in segments that can affect HCAs (for example, pipe defects, corrosion and excavation-induced damage);

- identifying additional measures to address the most significant pipeline threats, including actions to prevent and mitigate releases and can go beyond repairing the discovered defects;

- evaluating regularly all information about the pipeline and its location-specific integrity threats to determine when future assessments should be performed and what methods should be selected to conduct those assessments;

- documenting compliance with PHMSA and other government or regulatory authorities;

- evaluating periodically the effectiveness of the integrity management program and identifying improvements to enhance the level of protection, generating safety programs and emergency response plans and communicating a set of best practices to personnel involved in the construction, operation, maintenance and repair of its pipeline infrastructure.

Inspection and Integrity Services

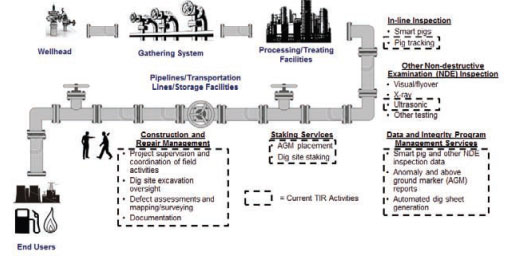

The diagram below illustrates an array of inspection and integrity services that may be provided to operators of pipelines and related assets.

In-line Inspection

Pipeline inspection primarily applies non-destructive examination, or NDE, methods to ensure asset integrity. NDE is the examination of pipeline assets without impacting the future usefulness of the assets. The examination method also allows for minimum operational interruption of the assets undergoing inspection.

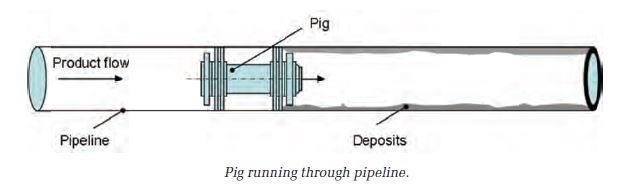

A common device used in the NDE of pipeline infrastructure is a pipeline inspection gadget, or pig. A pig is a cylindrical device that is introduced into the pipeline and is transported through the pipe typically without interrupting operations. Pigs perform a variety of functions inside the pipe, including debris and condensate cleaning, plugging, product separation, hydro testing, dewatering and inspection. Inspecting pigs, referred to as in-line inspection pigs, or smart pigs, contain testing devices and collect information while traveling through the pipeline.

Pig inspection can take days to weeks depending on the length and condition of the pipeline being inspected. While the pig is traveling through the pipeline, inspectors must track the location of the pig and catalog data from the pig. The results of pig testing are used by the pipeline operator to determine anomalies and sections of the pipeline targeted to undergo further examination.

Other Non-Destructive Examination (NDE) Inspection. In addition to pigging, modern NDE incorporates a variety of inspection methods performed by skilled personnel to test for structural flaws. These inspection methods may include: visual and optical testing (including aerial flyover), radiography, magnetic particle testing, ultrasonic testing, penetrant testing, electromagnetic testing, leak testing and acoustic emission testing. Skilled technicians are used to perform these types of NDE inspection of pipeline assets, as many methods use high specification machinery.

Data and Integrity Program Management Services. Smart pigs and other NDE inspection methods generate large quantities of data that need to be maintained, integrated and evaluated as part of the pipeline operators’ integrity management program. Independent inspectors can assist pipeline operators in maintaining data and generating documentation relating to the operators’ integrity management program and the associated construction, operation, inspection, maintenance, repair and regulatory compliance activities.

Staking Services. The locations along the pipeline where the pig identifies potential anomalies must be marked with stakes in preparation of additional testing or maintenance work. Inspectors mark the locations with an above ground marker consisting of a steel pin and survey lathe. The inspector also records the GPS coordinates of the location. The stakes are used by the pipeline operator to establish dig sites along the pipeline route to carry out the necessary maintenance work. Once a maintenance plan is formulated, the pipeline operator will hire a specialized construction team to begin the maintenance program.

Construction and Repair Management. Inspectors will work with pipeline operators’ management and employees to supervise all stages of construction and repair projects to ensure industry and regulatory standards are met. An inspector’s role in construction and repair oversight can include:

- Dig site excavation oversight and documentation;

- Defect assessments and mapping/surveying, including corrosion, dents, third-party damage, stress corrosion cracking, lamination, ultrasonic and NDE oversight;

- Repair documentation, including recoat, sleeve (permanent or temporary) or pipe replacement;

Documentation gathering and report assimilation, including client reports, photographs, defect rubbings (permanent record of repaired defect), safety meetings and PHMSA mandated records that must be kept for the life of the pipeline.

Regulation

PHMSA has authority over pipeline safety for interstate lines and retains responsibility for enforcement. However, PHMSA can designate a state to act as its agent in the inspection of interstate lines. Additionally, certain Federal statutes specifically allow states to assume responsibility for most regulation of intrastate pipelines through an annual certification. To do so, states must adopt regulations that are consistent with existing federal regulations. Pursuant to the Natural Gas Pipeline Safety Act of 1968, or NGPSA, and the Hazardous Liquid Pipeline Safety Act of 1979, or HLPSA, as amended by the Pipeline Safety Act of 1992, or PSA, the Accountable Pipeline Safety and Partnership Act of 1996, or APSA, the Pipeline Safety Improvement Act of 2002, or PSIA, the Pipeline Inspection, Protection, Enforcement and Safety

Act of 2006, or the PIPES Act, and the Pipeline Safety, Regulatory Certainty and Job Creation Act of 2011, or the 2011 Pipeline Safety Act, the Department of Transportation, or DOT, through the PHMSA, regulates pipeline safety and integrity. Among other items, these regulations require the operators of covered pipelines to:

- perform ongoing assessments of pipeline integrity;

- identify and characterize applicable threats to pipeline segments that could impact an HCA;

- improve data collection, integration and analysis;

- repair and remediate the pipeline as necessary;

- implement preventive and mitigating actions.

In 2010, serious pipeline incidents focused the attention of Congress and the public on pipeline safety. Legislative proposals were introduced in Congress to strengthen PHMSA’s enforcement and penalty authority, and expand the scope of its oversight. On January 3, 2012, the 2011 Pipeline Safety Act was signed into law. The 2011 Pipeline Safety Act amends the NGPSA

and HLPSA in a number of significant ways, including:

- authorizing PHMSA to assess higher penalties for violations of its regulations;

- significantly limiting the applicability of a ‘‘grandfather clause’’ which effectively provided exemptions from certain testing and inspection requirements for natural gas pipelines constructed before 1970;

- requiring PHMSA to adopt appropriate regulations within two years requiring the use of automatic or remote-controlled shutoff valves on new or rebuilt pipeline facilities and to perform a study on the application of such technology to existing pipeline facilities in HCAs;

- requiring operators of pipelines to verify maximum allowable operating pressure and report violations within five days;

- requiring PHMSA to study and report on the adequacy of soil cover requirements in HCAs;

- requiring PHMSA to evaluate in detail whether integrity management requirements should be expanded to pipeline segments outside of HCAs (where the requirements currently apply).

Effective October 25, 2013, PHMSA adopted new rules increasing the maximum administrative civil penalties for violations of the pipeline safety laws and regulations after January 3, 2012 to $200,000 per violation per day, with a maximum of $2,000,000 for a related series of violations. In addition, PHMSA published a final rule in May 2011 expanding pipeline safety requirements, including added reporting obligations and integrity management standards to certain rural low-stress hazardous liquid pipelines that were not previously regulated in such manner. On August 25, 2011, PHMSA published an advanced notice of proposed rulemaking regarding changes to gas transmission pipeline regulation which considered, among other items, strengthening integrity management plan requirements and expanding the definition of HCAs to bring more pipeline mileage under integrity management, and strengthening and expanding other requirements related to valve spacing, corrosion control, and underground gas storage caverns. PHMSA has also published advanced notices of proposed rulemaking to solicit comments on the need for additional changes to its safety regulations, including whether to extend the integrity management requirements to additional types of facilities, such as gathering pipelines and related facilities. PHMSA recently published an advisory bulletin providing guidance on verification of records related to pipeline maximum allowable operating pressure, which could result in additional pressure testing of pipelines or the reduction of maximum operating pressures. PHMSA has also issued guidance stating that it will focus near-term enforcement efforts on recordkeeping and integrity management, following recommendations by the National Transportation Safety Board. We believe this climate of increasingly stringent regulation and the significant increase in penalties for violations of safety requirements embodied in the 2011 Pipeline Safety Act will cause pipeline operators to increase the number and types of pipeline inspections they conduct, and thereby increase demand for third-party inspection and integrity services. Customers and Sources of Revenue. Independent inspection and integrity services providers have a diverse customer base that is largely dictated by the current regulatory environment. Key customer groups include:

- Midstream pipeline companies. Traditional midstream companies own and operate the pipeline networks and associated facilities that connect hydrocarbon producing regions with refiners, distributors and terminal users. Midstream companies are historically the largest consumers of independent inspection and integrity services and work closely with inspectors to maintain annual inspection programs to ensure assets remain in compliance.

- Oil and natural gas exploration and production companies, or producers. Oil and natural gas producers often control the gathering system associated with its producing wells and

are responsible for maintaining recurring inspection programs to meet regulatory compliance. Pipe used in gathering systems has a smaller diameter than mainline pipeline systems, and prior to the Pipeline Transportation Safety Improvement Act of 2011, were subject to less scrutiny than larger diameter pipeline assets. - Local Distribution Companies, or LDCs, and Public Utility Companies, or PUCs. LDCs and PUCs operate and maintain the infrastructure associated with localized distribution of public services, including natural gas, to residential, commercial, industrial and government end-users. LDCs and PUCs represent a small but growing component of independent inspection and integrity services customer base, as recent high profile accidents involving infrastructure maintained by LDCs and PUCs has increased independent oversight of recurring inspection programs.

Customers typically pay the independent provider a fee consisting of a daily or hourly rate for the provider’s inspection and integrity services personnel. The daily or hourly rate generally depends

upon the inspector’s skills, certifications and years of experience. The customers also normally reimburse certain expenses of the inspectors, including mileage for travel to the project, and pay a per diem for inspectors’ other expenses. Generally, reimbursable and per diem expenses are invoiced to customers by service providers at cost (without any profit margin). Some customers agree to pay the inspector seven days per week and others only pay six days per week despite the fact they are in the field near the jobsite and away from their permanent residence.

Pipeline Inspection and Integrity Services Industry Trends

We believe that the following trends will increase the demand for pipeline inspection and integrity services.

Growing oil and natural gas infrastructures. Increasing North American oil and natural gas production requires commensurate investment in infrastructure to process and transport the oil and natural gas from producing regions to end markets.

The Interstate Natural Gas Association of America, or INGAA, has estimated that an average of 1,400 miles of mainline natural gas transmission pipeline, 800 miles of oil transmission pipeline, 500 miles of NGL transmission pipeline, 16,500 miles of natural gas gathering lines and 600 miles of natural gas laterals connecting power plants, processing facilities and storage fields will be constructed per annum from 2011 through 2035, for a total investment in oil and natural gas infrastructure in North America of more than $250 billion. The increase in oil and natural gas infrastructure investment will result in higher spending

on inspection and integrity services as the incremental pipeline infrastructure will be subject to regulatory oversight and mandatory inspection programs.

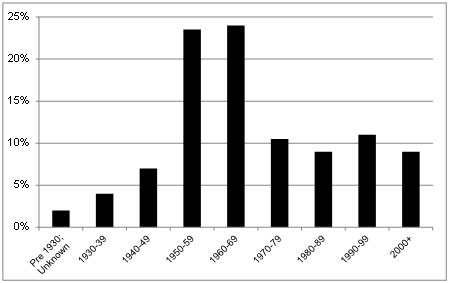

Aging pipeline and related infrastructures. According to the INGAA, more than 60.0% of all active U.S. pipeline infrastructure was installed more than four decades ago. Aging pipeline infrastructure is more susceptible to failures such as external corrosion, rain/flood damage, excavation damage, manufacturing defects, component defects, weld defects and stress corrosion cracking.

Percentage of U.S. Pipe Mileage Installed By Decade

Increased regulatory oversight. Owners and operators of pipelines and related infrastructure assets face increasingly stringent government regulations and safety requirements. Failure to meet these standards can result in a higher level of scrutiny by regulators, reduced volumes of activity and lost revenue, significant financial liabilities in the forms of fines, higher insurance premiums and damage payouts, tarnished corporate brand value and, in some cases, civil and criminal liability. As a result, owners and operators are seeking highly reliable independent service providers with a proven track record of providing inspection and integrity services on a broad basis to assist them in meeting the increasingly stringent regulations and safety requirements.