Water and Environmental Services

Water and Environmental Services

Various waste byproducts are generated during drilling and completion of, and production from, crude oil and natural gas wells, and an array of federal and state rules and regulations mandate that these byproducts be disposed of in an environmentally safe manner. We currently focus on the disposal of flowback and produced water waste fluids (collectively referred to in the industry as ‘‘saltwater’’), which includes brinish fluids returned to the surface during a well’s completion and production phases. The timely disposal of these fluids is required by oil and natural gas exploration and production companies, or producers, during the lifespan of their producing oil and natural gas wells and with each new oil and natural gas well drilled and completed. The most common method of saltwater disposal is to transport the flowback and produced water to facilities that treat and dispose of the wastewater. We are not directly engaged in the trucking of saltwater but own and operate saltwater disposal (“SWD”) facilities. Key considerations for us and other SWD facility operators in determining the location of facilities include: the location of existing and expected drilling and production activity; the number, size and financial strength of associated producers; the geological characteristics of the area; access to power infrastructure and roads or pipelines for transportation; and the ability to obtain the necessary permits to conduct operations. We also consider the ratio of water to hydrocarbon, or the water cut, the water decline curve, the expected lifespan of the SWD facility based on the waste streams being disposed and the presence of competing SWD services providers. The diagram below illustrates the use and disposal of water during the oil and natural gas drilling, completion and production phases.

Various waste byproducts are generated during drilling and completion of, and production from, crude oil and natural gas wells, and an array of federal and state rules and regulations mandate that these byproducts be disposed of in an environmentally safe manner. We currently focus on the disposal of flowback and produced water waste fluids (collectively referred to in the industry as ‘‘saltwater’’), which includes brinish fluids returned to the surface during a well’s completion and production phases. The timely disposal of these fluids is required by oil and natural gas exploration and production companies, or producers, during the lifespan of their producing oil and natural gas wells and with each new oil and natural gas well drilled and completed. The most common method of saltwater disposal is to transport the flowback and produced water to facilities that treat and dispose of the wastewater. We are not directly engaged in the trucking of saltwater but own and operate saltwater disposal (“SWD”) facilities. Key considerations for us and other SWD facility operators in determining the location of facilities include: the location of existing and expected drilling and production activity; the number, size and financial strength of associated producers; the geological characteristics of the area; access to power infrastructure and roads or pipelines for transportation; and the ability to obtain the necessary permits to conduct operations. We also consider the ratio of water to hydrocarbon, or the water cut, the water decline curve, the expected lifespan of the SWD facility based on the waste streams being disposed and the presence of competing SWD services providers. The diagram below illustrates the use and disposal of water during the oil and natural gas drilling, completion and production phases.

Salt Water Disposal

The Role of Hydraulic Fracturing The oil and natural gas industry has disposed of wastewater streams generated during its drilling, completion and production phases for decades, including the use of subsurface injection since the 1930s. Over the last several years, the application of hydraulic fracturing has significantly increased fresh water usage in well stimulation and volumes of saltwater recovered from oil and natural gas wells. This growth has led to an increase in the number of SWD facilities required to support existing production and new drilling and completion activity. Hydraulic fracturing is a well stimulation process that utilizes large volumes of pressurized water combined with fracturing chemical additives and sand or alternative proppant to crack open previously impenetrable rock to release hydrocarbons. When the pressure exceeds the rock strength, the fractures in the rock formation open or extend up to several hundred feet, thereby increasing the flow of oil and natural gas into the wellbore. The proppant holds the fractures in the shale rock formation open when the pressure is released, which allows hydrocarbons and water to flow up to the surface. According to Spears & Associates, almost every U.S. onshore oil and natural gas wells completed during 2012 utilized hydraulic fracturing techniques. While hydraulic fracturing commonly is associated with the initial completion of a new well, hydraulic fracturing techniques can be reapplied during the life of the well to stimulate the initially targeted hydrocarbon-bearing formations or to stimulate additional hydrocarbon-bearing formations. This generally leads to additional saltwater requiring disposal.

Flowback and Produced Water Oil and natural gas operations produce two primary types of saltwater waste streams: Flowback water is the fluid that returns to the surface during and for the weeks following the hydraulic fracturing process. Based on an April 2010 study by the University of North Dakota, the volume of water used in the hydraulic fracturing of a new horizontal well in the Bakken Shale region of the Williston Basin in North Dakota ranged from 0.5 million to 3.0 million gallons with between 17.0% and 47.0% of this water returning to the surface as flowback water within ten days of applying hydraulic fracturing, with the remainder of the injected water returning to the surface at a later date or absorbed in the formation. A June 2011 report of the University of Texas at Austin estimated that 0.2 million to 1.6 million gallons of water are typically used in the hydraulic fracturing process of a new well in the Permian Basin region. A November 2012 presentation by the U.S. Department of Interior Bureau of Reclamation indicates that hydraulic fracturing in the U.S. utilizes 0.5 million to more than ten million gallons of water per well fracturing event. Flowback water consists largely of the water injected into the oil and natural gas wells during the hydraulic fracturing process but also includes clays, fracturing chemical additives, dissolved metal ions and total dissolved solids. At some point, the water recovered from an oil and natural gas well makes a transition from flowback water to produced water for the remaining life of the oil and natural gas well. The transition point can be difficult to discern but is often identified by the chemical composition and weight of the recovered water and the rate of return. Flowback water generally has a higher flow over a matter of weeks while produced water has a lower flow over the lifespan of the well. The impurities and variable nature of flowback water can make it more challenging to treat and dispose than produced water, potentially increasing the operating expenditures and maintenance capital expenditures of an SWD facility versus those incurred with produced water. As a result, the market-driven price for disposing of flowback water can be higher than that of produced water (as is the case currently in the Bakken Shale region), although a barrel of flowback water often contains a higher volume of residual oil than found in a barrel of produced water, which can be a revenue source and offset the need for differential per barrel pricing between flowback and produced water. Produced water is naturally occurring water found in hydrocarbon-bearing formations that flows to the surface along with oil and natural gas. Produced water has high levels of total dissolved solids and leaches out minerals from the formation including barium, calcium, iron and magnesium. Produced water also can contain dissolved hydrocarbons such as methane, ethane and propane, and, like flowback water, requires proper treatment and disposal. The volume of produced water generated during oil and natural gas production can differ depending on formation characteristics, well design, use of enhanced recovery techniques and the age of the well. Produced water is the largest waste byproduct by volume associated with oil and natural gas production, with the amount of produced water relative to hydrocarbon varying based upon the region and geological formation. A September 2009 study by the Argonne National Laboratory estimated that in 2007, the U.S. onshore oil and natural gas industry produced approximately 1.3 billion barrels of oil, 21.3 trillion cubic feet of natural gas and 20.3 billion barrels of produced water. Per the Argonne study, the majority of this produced water was re-injected for enhanced hydrocarbon recovery (e.g., waterfloods) with virtually all of the remaining produced water (or more than 7.1 billion barrels) injected subsurface for disposal at an SWD facility. Produced water is typically generated, and saltwater disposal services are required, for the life of an oil and natural gas well, which can span multiple decades. Produced water can represent up to 98.0% of the fluid brought up from U.S. onshore wells nearing the end of their productive lives.

Saltwater Disposal Facilities The primary methods for handling flowback and produced water include:

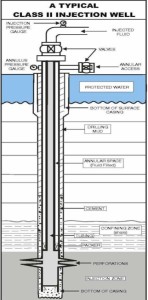

- U.S. Environmental Protection Agency (EPA) Class II SWD wells, where flowback and produced water are treated and injected subsurface

- Evaporation pits, where the water is evaporated at the surface

- Recycling facilities, where flowback and produced water are treated in a manner that some portion of the water can be recycled for future fracturing processes or other beneficial uses

In all cases, the flowback and produced water must be processed and disposed of in a manner consistent with applicable environmental regulations. The manner in which the disposal process is performed is dictated in part by local regulations that can vary from region to region or state to state. As a result of these regulatory requirements and the level of expertise required to properly process and dispose of saltwater, producers are requiring increased compliance expertise and operational experience from their service providers. The most common method for handling flowback and produced water is through an SWD facility that injects the water subsurface at depths that are substantially deeper than the drinking water supply. We follow this approach, providing saltwater disposal services through our nine owned SWD facilities and four other managed SWD facilities. SWD facilities serving the oil and natural gas industry typically include offload facilities, filtration systems, settling tanks, storage tanks, pumps, an injection well and associated equipment to separate residual oil from the wastewater and inject the wastewater deep underground into geologic formations approved by governmental agencies. Injection wells are regulated by the EPA’s Underground Injection Control program as Class II injection wells. Class II injection wells are approved for the injection of saltwater associated with oil and natural gas production. The EPA currently estimates that there are approximately 144,000 Class II injection wells in operation in the U.S., of which approximately 20% are SWD injection wells. The remaining 80% of the Class II injection wells are primarily enhanced recovery wells. While all SWD facilities are categorized as EPA Class II injection wells, the characteristics of an SWD facility can vary based on a number of important factors, including:

- proximity to existing and expected oil and natural gas production;

- maximum formation injection capacity, including its permeability and porosity;

- the presence of high-capacity pumps onsite for injection;

- location and ingress and egress, including access to right of way for piping and highways and roads for trucking, as well as truck weight limits and night curfews;

- power availability;

- presence of personnel and/or video monitoring at the facility;

- spill containment and other protection systems;

- oil separation and storage systems.

SWD facilities are generally owned by (i) producers with dedicated disposal facilities for their own produced water and (ii) third-party service providers who accept wastewater from the area’s various producing oil and natural gas wells at their SWD facilities, or commercial SWD facilities. Ownership in the saltwater disposal industry is fragmented. For example, data available from the Texas Railroad Commission lists over 900 operators owning approximately 2,500 commercial SWD wells in Texas with the largest operator having 73 SWD wells and several hundred operators owning only a single SWD well.

Transportation of Saltwater There are two primary methods of transporting saltwater from oil and natural gas well location to an SWD facility. Trucking is the primary method of transporting saltwater and often is the only feasible method of transporting flowback water, as producers often need to dispose of saltwater before pipeline infrastructure can be built. Trucking has the advantages of lower capital costs for the producer compared to pipelines and the ability to access multiple SWD facilities. However, operating expenses associated with trucking (such as labor and fuel costs), costs of complying with various local regulations, insurance and costs related to road repairs and accidents can be significant. Trucking rates may be particularly higher in newer basins with fewer trucking alternatives than in more established basins with more trucking competitors. We do not provide trucking services to the producers. Pipeline (also called gathering system) is an alternative method for transporting saltwater from the well location to the SWD facility. The initial capital costs to build the infrastructure for piping saltwater are greater than the capital costs of transporting the saltwater by truck, but the operating expenses to the producer after the pipeline is constructed can be significantly lower, and the net economics over the lifespan of the well can be substantially superior, especially for long-lived oil and natural gas wells. According to the April 2010 study by the University of North Dakota, transportation costs in the Williston Basin accounted for 56.0% to 84.0% of the producers’ total water handling costs. Piping produced water is increasingly being pursued by many producers to reduce their carbon footprint and contingent liability exposure in addition to lowering the operating costs associated with transporting water. We do have pipelines into some of our SWD facilities and are pursuing additional opportunities with producers. Saltwater Disposal Customers and Contractual Arrangements There are primarily two classes of customers for commercial SWD facilities: Producers that contract directly with the SWD facility operator to ensure that the saltwater associated with their operations, which is transported by pipeline or trucking companies, is injected into a nearby facility that meets the producer’s environmental and safety criteria. Trucking Companies hired by producers to transport saltwater associated with the producers’ operations to commercial SWD facilities. Some producers obtain permits to own and operate private SWD facilities for their own saltwater or may otherwise enter into an arrangement to use a commercial SWD facility. Commercial SWD facilities are open to the public via trucking or pipeline and are able to take flowback and produced water from any source. Commercial SWD facilities typically charge customers a fee per barrel of saltwater to be disposed, which fees can vary between flowback and produced water depending on the competitive dynamics, content and operating costs specific to a geographic region. In addition, commercial SWD facilities may generate revenue from the sale of residual oil that is separated from the saltwater before injection. Generally speaking, flowback water contains more residual oil than produced water, unless the producer has put in place processes for removing residual oil prior to its being transported for disposal.

Trends in the U.S. Saltwater Disposal Industry We believe that the following trends will positively impact the demand for U.S. saltwater disposal services: Increasing levels of U.S. oil and natural gas production. Completed oil and natural gas wells historically have produced consistent levels of hydrocarbon and saltwater streams over the life of the well, which may span several decades. The level and type of U.S. drilling and completion activity in recent years has resulted in an increase in the volumes of oil and natural gas production in the U.S. onshore market. According to the U.S. Energy Information Administration, or EIA, crude oil and marketed natural gas production in the continental United States excluding the Gulf of Mexico has grown from 10.2 MMboe per day in 2000 to 15.4 MMboe per day in 2012, an increase of 51.0%, and is expected to increase to 17.7 MMboe per day for 2014. Generally, growing oil and natural gas production has an associated growing volume of saltwater streams that either needs to be re-injected, recycled or disposed. Increasing capital needs driving outsourcing to independent service companies like us. Since the early 1990s, many producers, including ConocoPhillips, Marathon, XTO and Endeavor Energy, have spun off or outsourced their oil and natural gas gathering, transportation, compression and processing needs as they focus their operations and capital spending on oil and natural gas exploration, development and production. We believe that this trend could extend to the saltwater disposal industry, providing us with increased opportunities to gather (or pipe), treat and dispose of the producers’ saltwater. Increasing public and regulatory scrutiny driving outsourcing to independent service companies like us. Ongoing public and regulatory scrutiny of the oil and natural gas industry, as well as the inability of producers to train and retain in-house expertise, can be a further driver of outsourcing by producers of saltwater gathering, treatment and disposal services. Violations of environmental laws and regulations can generate substantial fines and significant negative publicity. We believe that this will generate increased long-term demand as producers concentrate on core operations and determine that it is more cost effective to manage compliance with an increasingly complex set of regulatory requirements over multiple basins and regulatory jurisdictions through an experienced independent company like us.

Water-Flood

Introduction to Well Logging

Oil and Gas Production